The Mobile Retail Associate: 4 Best Bets And Best Practices For 2013

March 2013 Integrated Solutions For Retailers

By Matt Pillar, editor in chief

The need to arm associates with mobile devices is well-defined. The applications, hardware, and networks are market-ready. Now we face the biggest challenge: the systemic and operational change necessary to make it all work.

If the word on the street is any indication, you’ve accepted the challenge of a relatively new phenomenon; consumers are wielding mobile technology that gives them better access to product, price, and promotional information than your store associates have. To mitigate the risk that consumer-held smartphones and tablets might displace the frontline associates who were once a great differentiator in your provision of value — costing you opportunities to make impressions, guide and save sales, box out your competition, and develop customer loyalty along the way — you’re ready to rush mobile devices and applications to your stores at a breakneck pace.

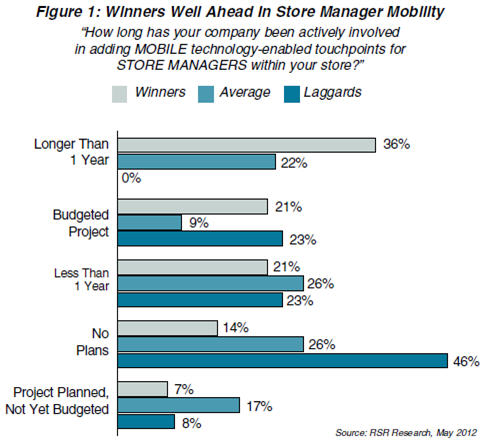

According to recent research from RSR (Retail Systems Research), the 46% of poor-performing, or “Laggard,” retailers who haven’t made plans to arm store managers with mobile access to critical back office and customer-facing applications are ignorant at their own peril; the 36% of RSR’s “Winners” who have had mobile devices and applications in store managers’ hands for more than a year are greatly outperforming their competition in terms of customer service, brand satisfaction, operational efficiency, and sales. See Figure 1.

Nordstrom is expanding the deployment in its well-publicized mobile POS push to include new cross-channel ordering flexibility. JCPenney announced its intent to displace physical POS stations with mobile POS across the chain this year. Perry Ellis is going mobile chainwide this quarter on the heels of a successful Q4 2012 pilot. Home Depot has been spending big money on mobile enablement of its associates since 2010. Bass Pro Shops, Disney Stores, Lowes, Target, Walmart, and Starbucks … the list of customer-facing mobile technology adopters is long and quickly getting longer by the day. As these venerable brands that shape the consumer experience invest heavily in their mobile strategies, you need to be on that list as well.

The rollout activity we’ve seen to date has made it abundantly clear that the technology is ready. Hardware vendors, application developers, and integrators have developed a myriad of solutions and seemingly limitless form factors that perform securely to meet the needs of early adopters. But the technology and integration challenges met by the fits and starts of first generation mobile application deployment have been displaced by a new set of challenges that fall squarely on the shoulders of operations and strategic decision makers.

In addition to examining our own research and that conducted by leading analysts, we talked with a number of experts in the mobile retail solutions space to identify four hot opportunities for mobile deployment in 2013. These are four key areas for measurable mobile differentiation, where wellmanaged device and application deployment enhance operational productivity and bridge the customer-associate mobile divide. However, the common consensus is that while the technology to enable these opportunities is widely available, retailers need to wade into their deployment more carefully than they have to date. As we discuss each application for associate-level mobile deployment, we’ll focus on the operational challenges each presents and offer some advice on how to avoid the pitfalls that can deep-six a well-intentioned mobile initiative.

In addition to examining our own research and that conducted by leading analysts, we talked with a number of experts in the mobile retail solutions space to identify four hot opportunities for mobile deployment in 2013. These are four key areas for measurable mobile differentiation, where wellmanaged device and application deployment enhance operational productivity and bridge the customer-associate mobile divide. However, the common consensus is that while the technology to enable these opportunities is widely available, retailers need to wade into their deployment more carefully than they have to date. As we discuss each application for associate-level mobile deployment, we’ll focus on the operational challenges each presents and offer some advice on how to avoid the pitfalls that can deep-six a well-intentioned mobile initiative.

Mobile POS: Putting The Pieces Together

While mobile POS applications are perhaps the most well-publicized mobile initiatives in retail, experts agree that they’re also the most fraught with operational difficulty. Brad Fick is president at Direct Source, a large retail technology integrator with a broad portfolio of solutions in its arsenal. He’s got an in-the-weeds vantage point from which to monitor the adoption of mobile retail technologies; his company is a go-to technology integrator for several of the world’s largest and most powerful retail brands. That puts him at the table with the big boys from the point of early-stage mobile strategy discussion through the architecture and deployment phases. From Fick’s point of view — and bear in mind it’s his job to sell this stuff — even some of the biggest retailers are moving a little too fast, especially when it comes to the payment aspect of mobile POS.

“It’s clear from the discussions we’re having with many of the tier-ones that they simply haven’t put as much thought into mobile payment as they should,” he says. Fick estimates the motivation for mobile POS is twofold and equally divided, but not necessarily equally prioritized. “Half the motivation for mobile comes from the desire to follow the lead of Apple in the creation of a better shopping experience. The other half is rooted in the foundational truth that retailing is about tendering sales.” He says the majority of the time, the C-suite is so enamored by the tablet — the new toy — that the payment “plumbing” and process-oriented aspects of mobile POS become secondary to the evaluation, and he calls that a big mistake. The very first question that should be addressed when evaluating any tablet or mobile device for POS usage, says Fick, is how it will leverage payment acceptance hardware from companies like VeriFone and Ingenico to accommodate payment.

The good news is that technology and security concerns have largely been addressed. If you want to render POS on an iPad and accept payment on the floor in a manner that satisfies PCI (payment card industry) requirements, you can certainly do that. What seems to be lost on corporate decision makers is that the realization of the enabling technology doesn’t address the physical and operational challenges stores are now struggling with as they roll out these devices. “I’m very excited about tablets and PDAs in stores, and there’s an incredible opportunity for us there,” says Fick. “However, in all the large deals we’re involved in, mobile POS is being engineered at the corporate level and handed to stores without their input. That’s a shortfall.”

At issue are the ergonomics of usage, which drive associate acceptance and, ultimately, can make or break the deployment. Payment processing companies have come to market with a variety of sleds and attachments designed to enable the integration of payment card readers with a variety of tablets and devices. Some of these card readers are attached directly to the tablet or integrated in the case or handle; others are pushing detached or “floating” Bluetooth card readers. Some cases and sleds feature handles for secure manipulation of the device during the transaction; others include a tether or wrist strap.

These seemingly inconsequential features have big implications on the important physical process you choose to adopt when it comes time to tender payment. Do you want your associates to hand the PIN pad/signature capture device to the customer at payment, or are you comfortable allowing associates to literally hand the entire POS station over to the customer for payment information inputs? What combination of card reader and harness/strap/handle will best accommodate the chosen approach?

These up-front decisions will also profoundly impact the TCO (total cost of ownership) and management of the devices themselves. When free-floating payment card readers break independently of the tablet, they can be serviced individually, and vice versa. When integrated readers (or the tablets they’re connected to) break, the whole thing has to be taken out of commission.

The deeper one delves into the mobile POS process discussion, the more questions that are coaxed out of previously ignored recesses of the mind. How will you expect your associates to bag or package the garments and other products they sell via mobile POS? How will you monitor POS transactions conducted by mobile associates for the exceptions and anomalies that indicate coaching opportunities, or worse, illicit behavior?

Fick says these physical use/case concerns make a strong case for store-level involvement early on, but he doesn’t see enough of that happening.

At VeriFone, VP of Business Development and Strategic Initiatives Jeff Wakefield sees the points made by Fick playing out in practice. “We recently spent a great deal of time camped out in stores, observing the application of mobile POS in stores where it’s been deployed,” he says. “What we saw indicated that these great intentions to serve customers on the selling floor often fall apart at the execution level when associates and consumers migrate back to the check stand — or to where the check stand used to be — to consummate the transaction, despite their freedom to roam.” Wakefield calls it a breakdown at the training level, equating the safety of the cash wrap to the comfort a public speaker gets from clutching the podium. “Too often, I don’t think retailers realize the significance of the change before they roll out the technology. Since the day NCR introduced the electromagnetic cash register in 1906, there’s been a counter, a cash drawer, a bagging station, and eventually a conveyor, a receipt printer, and a place to remove security tags. This is what we’ve known, and change to that behavior can’t be expected by handing an associate an iPad and a card reader and sending them on their way.”

Wakefield says VeriFone has more than 60 mobile POS deployments under its belt and that the technology works at all of them. The varying degrees of success each has achieved, however, is predicated solely on the retailer’s ability to manage systemic and operational change. He says developing the training necessary to exploit the value of mobile POS should derive from the goal of the deployment, and that generally, the retailer’s goal will fall into one of two camps. “High-touch retailers who depend on consultative sales are looking for deeper levels of integration with e-commerce, inventory, and CRM applications. For those associates, training should focus on the service aspects of mobility and how those lead to a seamless transaction. For the everyday low price crowd, training should focus more simply on how mobility speeds up the path to the transaction and gets consumers out the door.”

Mobile Clienteling: CRM Finds Its Legs

Arguing the nuance of the definitions of CRM and clienteling is a pointless debate, but it’s safe to say that mobile access to customer purchase and preference data has ushered in new relevance to the idea that 1:1 marketing is achievable in retail. In the newly released RSR report The Impact Of Mobile On Retail, “business to consumer” and “marketing” ranked highest when retailers were asked, “Which functional areas stand to benefit the most from mobile applications?” See Figure 2 below.

Still, in the same report only slightly better than 40% see empowering their employees with a mobile application as a top opportunity. RSR analysts and report authors Brian Kilcourse and Steve Rowen say that response falls short of the opportunity at hand. “An empowered customer demands much the same [empowerment] from the employees she engages with,” they say. “Retailers need to realize that the only way to accomplish this is by giving the employee the same (or better) information as the consumer now has at her fingertips.”

Both Fick and Wakefield point to how Lowes is bucking that trend, citing the retailer’s new “MyLowes” initiative as a great example of how big-box retailers can push clienteling beyond its traditional Neiman Marcus/Nordstrom stomping ground. Saving shopper purchase data enables the Lowes clienteling application to recall specifics such as the exact paint a consumer used in her living room or the warranty information for the dishwasher she purchased last year. Consumers can also use tools within the application to save shopping lists, plan projects, and save room dimensions. In addition to empowering consumers with Web and mobile-based access to the app, iTouch devices have been deployed to Lowes store associates in an effort to meet the objective that Kilcourse and Rowen call for — giving associates access to information the consumer doesn’t have.

The new consumer expectation of applications like this is that they provide value, but that provision of value works both ways. By giving the consumer something useful or valuable in return, retailers create an opportunity to gather more data that can be accessed via the mobile device to consummate the sale later. In a similar example, a national car care chain is using mobile clienteling to create upsell opportunities by reminding consumers when their windshield wipers need to be replaced or their oil needs to be changed. “There are tremendous opportunities to leverage mobile technologies to achieve 1:1 marketing, especially when the CRM data is centralized in the cloud making it real time and easily accessible across the enterprise,” says Wakefield. “It used to be something you associated with commissioned salespeople in high-end retail, but the applications and advantages are available to virtually any retailer now. Call it CRM, call it clienteling; I call it good business.”

Workforce Management: An Untapped And Unplanned Opportunity

According to the aforementioned research from RSR, the “store operations” function (management) fares almost as well as “business-to-consumer” and “marketing” in terms of mobile application deployment. But, “businessto- employee” and “workforce management” applications were not rated nearly as highly, languishing in the 25th percentile of interest.

This is ironic because, as the research states, when asked to rate the level they agree with various statements about mobility’s role in the retail experience, retailers’ top-rated response was that mobile’s primary ability is to enhance the overall value of the brand. See Figure 3 below.

Say report authors Kilcourse and Rowen, “Unto itself, this is hardly a problem. In fact, enhancing the overall brand is precisely how retailers should be viewing the tremendous value that new mobile technologies afford. What is problematic, however, is that much of what retailers share in the report — their actions — does not line up with this purpose. Instead, many of the findings of this research are in closer alignment to the second-most popular choice in the figure on this page: that the current purpose of a mobile strategy is to serve merely as an extension of the existing e-commerce offering.”

With certainty, using mobile devices to do little more than extend the digital platform into stores is the path of least resistance. But the path of least resistance is also often the path to least impact. Motorola, which last year unveiled a bevy of new mobile devices (see its SB1 smart badge and ET1 tablet for starters) aimed squarely at workforce and task management initiatives, begs to differ with the lackluster response to mobile as a store operations differentiator. And Fick says some Direct Source customers have seen so much value in WFM (workforce management) and task management applications that they’re starting the mobile journey there, not with mobile POS. “Just as it is in the physical realm, simplicity rules in digital execution of task management applications,” he says. “We have a customer achieving great results with a simple set of real-time cashier productivity reports developed for their iOS devices. The manager can view a graph that displays each cashier, color coded in green, yellow, and red to indicate whether they’re working above, at, or below standard,” says Fick. “If something is amiss, the manager can walk from wherever she is on the floor to see what’s going on.”

Here again, Fick warns that without the proper training that leads to manager acceptance, mobile deployment of WFM and task management applications can fail at the execution level. In some segments, turnover among store managers rivals that of associates, which can create a significant long-term mobile application execution challenge. The training challenge can be mitigated by the simplicity of the application, and the ubiquity of the devices and software platforms themselves contributes to a shorter training curve.

Inventory Management: Change Looms In Retail’s Original Mobile Proving Ground

In its 2012 Store Report, RSR’s Paula Rosenblum and Steve Rowen aptly noted the importance of recognizing the activities stores perform as a new node in the retail supply chain. While the point was made in the context of store compensation for filling orders placed through other channels (why else would they do it quickly and efficiently?), peeling back the layers of the store-as-a-fulfillment-center challenge reveals additional mobile hardware and operational/systemic challenges.

As retailers have rushed “consumer-grade” (for lack of a better term) iOS, Android, and now Windows 8 mobile devices into stores, they’ve done so with high hopes for cross-functionality. They’re hoping to leverage the same investments they’re deploying for mobile POS, clienteling, task management, and other applications to handle traditional back-room mobile data capture applications, such as receiving, transfers, and inventory. As this sort of activity becomes even more important and grows in volume due to consumer demand for the channel convergence that enables “buy anywhere, fulfill anywhere” retailing, retailers are faced with another set of serious mobile decisions.

Wakefield says there’s more discussion among VeriFone GlobalBay customers about the next generation of mobile devices for inventory management than all the other mobile applications combined. He and Fick both agree that the traditional back office mobile ADC suppliers — like Honeywell, Datalogic, and Motorola — are under siege from the likes of Apple, Android, and Microsoft. Does the case for “retail hardened,” purpose-built devices still have merit? “I’ll leave it to Apple to make that argument,” quips Wakefield. “The bulky device with function keys and numeric keypads is simply becoming irrelevant though. I’m not sold on a flat tablet for back office applications, but adding a scanner to an iPhone or an iPod that enables user features like one-hand operation and an intuitive interface is an attractive and less expensive option that retailers are migrating toward.” Fick agrees. “If you’re looking to use a tablet for inventory and receiving purposes, put thought into buying one or two wireless Bluetooth scanners and using the tablet for confirmation purposes,” he says.

As is the case with each of the mobile application areas discussed here, the systemic and operational challenges associated with an increase in fulfillment-type tasks at stores must be addressed. This year, workforce management solutions provider Kronos and supply chain/logistics solutions vendor Manhattan Associates announced a partnership designed to address that challenge, on the heels of last year’s merger of similar companies RedPrairie and JDA. These partnerships and mergers address the new store-level demand for crossfunctional systems, training, and budgeting/operations that are absolutely necessary for stores in the omni-channel environment. Just as store associates can’t be expected to become effective wandering POS stations simply because they’ve been handed a mobile POS, back-room associates surely can’t become omni-channel fulfillment enablers without the training and infrastructure they need to execute.

The Technology Is Ready; Are Your Stores?

The network, device, software, and security concerns that dominated the early discussions about mobile retailing have faded into the background. Integrators like Direct Source are developing new device deployment and management models (see its recent Hardware as a Service [HaaS] program for mobile device deployment) that make it easier to source, manage, and upgrade constantly evolving mobile hardware options. The development of the mobile retailing technology infrastructure has quickly reached a point of maturity. Still, mobile device and application deployment is not a plug and play proposition. If you are to succeed in the creation of customer experience differentiation, the enablement of faster checkout, and the decreased cost of POS infrastructure promised by mobile retailing, your challenge is now an organizational one.

To access the RSR research cited here, go to www.retailsystemsresearch.com. Registration and research access is free.